Explanatory film

National Emissions Trading

Our explanatory film shows how national emissions trading works and illustrates its positive impact on climate protection.

Source: Production: joernbarkemeyer.de

Why does Germany need national emissions trading (CO2 price)?

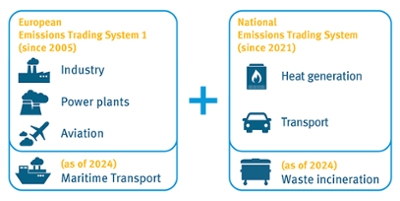

Man-made carbon dioxide (CO2) in the atmosphere contributes significantly to climate change. The European Union therefore introduced the European Emissions Trading System 1 (EU ETS 1) in 2005 as a cost-effective way of reducing greenhouse gas emissions from power stations, industrial plants and aviation.

National emissions trading (nEHS) includes the sectors that are not covered by the European Emissions Trading System 1 (EU ETS 1).

Because these sectors cause a large proportion of the CO2 emissions, not only in Germany, efforts are being made at a European level as part of the ‘Fit for 55‘ package to establish an EU ETS 2 for the buildings and road transport sectors. According to current plans, this is to start in 2027.

As the German Emissions Trading Authority (DEHSt) at the German Environment Agency, we are responsible for implementing the nEHS.

How does emissions trading work?

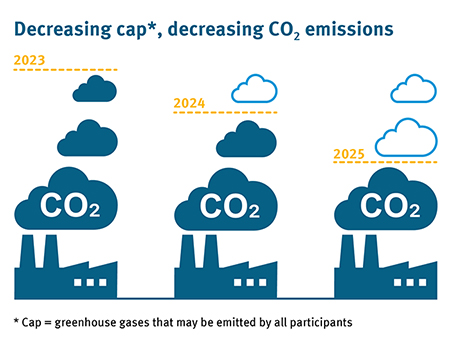

European and national emissions trading make it attractive for all participants to invest in climate protection. Both systems work on the ‘cap and trade‘ principle. A political decision is made on how much greenhouse gas can be emitted by all participants together ('cap'). There is no maximum limit for the individual participants.

Anyone who pollutes the air with greenhouse gases pays a price for each tonne of CO2 by purchasing certificates for it. In the EU ETS 1, some of the certificates have so far been allocated free of charge.

The price for these certificates is determined by trading ('trade') on the market. The lower the permitted greenhouse gas emissions, the scarcer and therefore more expensive the certificates become. If the price rises, the financial incentive to avoid CO2 emissions on the one hand and to invest in climate protection measures on the other, increases. In the nEHS, the price of the certificates is fixed during the introductory phase from 2021 to 2025.

Because we repeatedly receive enquiries as to whether the operation of water turbines or photovoltaic systems entitles involved parties to receive 'certificates', we would like to point out the following: participation in the compliance cycle of the respective emissions trading systems is not possible on a voluntary basis but is subject to legal requirements. This means that we cannot reward efforts to reduce emissions by issuing emission allowances (EU ETS 1) or nEHS certificates, even though we expressly welcome all efforts to reduce greenhouse gases.

Factsheet: national emissions trading

How do european and national emissions trading differ?

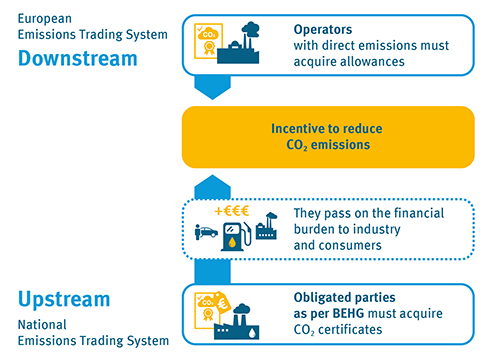

European emissions trading begins where emissions are generated in industry, power plants and aviation. Operators or aircraft operators must purchase emission certificates for the CO2 emissions they cause themselves (‘downstream emissions trading’).

The national emissions trading system has a different starting point. The obligated parties as per BEHG (Fuel Emissions Trading Act) such as gas suppliers, coal suppliers or companies in the mineral oil industry, must acquire pollution rights in the form of certificates (‘upstream emissions trading’). Thus they pay for the emissions that result from the subsequent burning of the fossil fuels by the end user.

The different starting points of the two systems are explained by the sectors involved. The most affected sectors of transport and heating include a large number of emitters, for example citizens who operate or heat their vehicles or houses with fossil fuels. To ensure that these people do not all have to take part directly in national emissions trading, participation takes place via the companies that place the fuels on the market, that is the obligated parties as per BEHG. They then pass the additional costs on to the consumers.

In comparison, European emissions trading 1 has far fewer stakeholders who therefore participate directly. Some companies are covered by both emissions trading systems due to their fields of activity. In this case, there are two mechanisms that rule out double loading. Obligated parties as per BEHG can reduce their surrender obligations when selling fuels to companies already covered by the EU ETS 1. This eliminates the CO2 costs of the fuel amounts for these installations. As a further option, companies covered by both systems can apply to us for compensation.

How is the greenhouse gas emissions target determined?

The amount of greenhouse gases that can be emitted by all participants in national emissions trading (‘cap’) is made up of the base amount and the increment. The base amount results from Germany's reduction obligations under the EU Climate Protection Regulation and concerns all CO2 emissions that are generated outside of European emissions trading 1 - that is within the scope of national emissions trading. It is determined in the Fuel Emissions Trading Ordinance. The cap increase corresponds to the fuel emissions for which a contribution was made in both the EU ETS 1 and the nEHS. These double-balanced emissions are allocated to the EU ETS 1 and not to the German emissions budget, which is why this amount is added to the nEHS cap. It will be published by us in the Federal Gazette.

Since in the initial phase (up to and including 2026) the sale of certificates follows the effective demand of the participants in the nEHS, the defined quantity target may subsequently be exceeded. In this case, Germany is obligated under the EU Climate Change Regulation to compensate entirely the resulting deficit.

Some companies are subject to both national and European emissions trading. These duplicated emissions are not be taken into account when calculating the base amount. For this reason, additional certificates to the corresponding extent are provided in the nEHS as an increment.

What fuels are covered by the national emissions trading system?

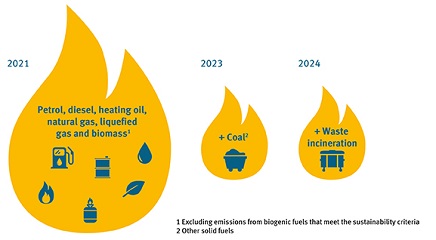

All fuels in the energy tax act are included in the national emissions trading system. These include petrol, diesel, heating oil, liquefied petroleum gas, natural gas and, since 2023, coal among others. Biomass that does not meet the sustainability criteria is also affected. From 2024, waste will also be included as a fuel.

How high will the CO2 price be?

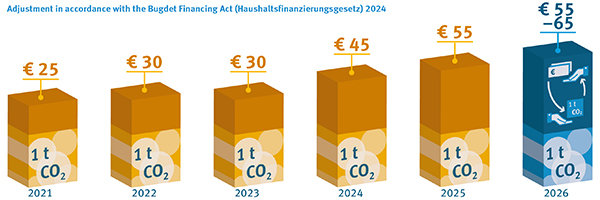

In order to give all stakeholders planning security during the introductory phase of the national emissions trading system (nEHS), the system starts with a fixed price phase. During this period, the prices for the nEHS certificates (nEZ) are regulated by law.

In the amendment to the Fuel Emissions Trading Act (BEHG), which came into force on 01/01/2024, it was decided that the CO2 price for the years 2024 and 2025 will return to the path provided for in the first amendment to the BEHG.

The auction phase begins in 2026. In 2026, nEHS certificates will be auctioned in a price corridor with a minimum price (55 euros per nEHS certificate) and a maximum price (65 euros per nEHS certificate). The price will form within this range depending on market demand.

How does national emissions trading affect consumers?

Citizens who use fossil fuels for heating or driving, for example, do not participate directly in national emissions trading. Instead, the distributors of these fuels are obliged to participate and pass on their additional costs to consumers.

The rising prices make it more profitable for customers to reduce their consumption - for example by renovating their buildings, switching to an electric car or installing a more energy-efficient and environmentally friendly heating system. This in turn leads to fewer greenhouse gas emissions.

In this way, national emissions trading makes an important contribution to climate protection.

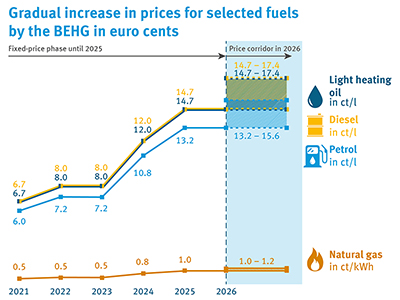

What additional costs does the carbon price cause for consumers?

During the introductory phase, the annual increase in CO2 prices is fixed. From 2026, the certificates will then be auctioned and the price will be within a corridor of 55 and 65 euros in the first year of the auction phase. Depending on the emissions intensity of the respective fuel, this will result in the additional costs for end consumers in the cent range shown in the figure.

Due to the mandatory admixture of biogenic fuels such as bioethanol in petrol or biodiesel in diesel, the CO2 price increase for these fuels is in reality lower than the values shown here, as there is no CO2 price for the biogenic admixture if sustainability is proven. For example, the CO2 price premium for E10 with a biogenic content of 10 percent would be around 1 cent lower in 2025. However, as the biogenic proportions in E10 vary in relation to the individual deliveries, they were not taken into account in this calculation for the purposes of simplification.

Are consumers supported in switching to climate-friendly technologies?

Due to national emissions trading, the use of fossil fuels such as heating oil or petrol is becoming more expensive.

The German government supports consumers in switching to energy-efficient and environmentally-friendly technologies with a variety of subsidy programmes. For example, the installation of climate-friendly heating systems is supported by investment grants from the Kreditanstalt für Wiederaufbau (KfW).

Further subsidies are available for thermal insulation. An energy consultation, which is also financially supported, identifies energy weaknesses in the buildings. The funding database of the Federal Ministry for Economic Affairs and Climate Action signposts consumers to the right offers.

What happens with the revenue from emissions trading?

Revenues flow into the Climate and Transformation Fund (KTF) This means that the nEHS revenues are currently largely used to finance technology funding and climate protection measures in Germany. This includes, for example, the transformation of heating networks, the expansion of the charging infrastructure and the ramp-up of the hydrogen economy. We, the German Emissions Trading Authority, are not responsible for the distribution of revenues.

In addition, electricity price compensation, carbon leakage compensation, and enforcement are refinanced through the revenues from emissions trading.