Participating in the nEHS from 2023 onwards

The Fuel Emissions Trading Act (BEHG) is the legal framework of the national emissions trading scheme (nEHS). Details on emissions determination and reporting are contained in the Emissions Reporting Ordinance (EBeV 2030). The Fuel Emissions Trading Ordinance (BEHV) regulates, among other things, the requirements for surrendering emission certificates.

The reporting and surrender obligations under the BEHG apply to carbon dioxide emissions that may arise from fuels placed on the market. In principle, all fossil and biogenic fuels placed on the market that fall under one of the Combined Nomenclature numbers listed in Annex 1 BEHG are subject to reporting requirements from 2023 onwards.

From 2024 onwards, fuels that do not fall under a number of the Combined Nomenclature in Annex 1 BEHG are also subject to reporting requirements if they are disposed of or recovered in installations pursuant to numbers 8.1.1 and 8.1.2 (with waste oil as the main fuel) Annex 1 of the 4th Federal Immission Control Ordinance (Waste Incineration Plants) and the installations are not subject to EU emissions trading.

Whether the fuels have to be reported in the emissions report and the associated emission allowances have to be surrendered depends on two preconditions:

- The fuel is deemed to be placed on the market pursuant to Section 2(2) or 2a BEHG. The BEHG distinguishes between three cases of "placing on the market" by obligated parties as per BEHG (see Table below).

- The fuel quantity of all fuels placed on the market shall result in at least one tonne of carbon dioxide before deductions pursuant to Sections 8 to 11 EBeV 2030 (including biogenic emissions) or before deductions to prevent double counting pursuant to Section 16 and double burden pursuant to Section 17 EBeV 2030. If the fuel emission quantity is less than one tonne of carbon dioxide, the reporting and surrender obligation shall not apply.

| Placing on the market by incurring the energy tax (Section 2(2)(1) BEHG) | A fuel is deemed to have been placed on the market if a tax liability arises for it in accordance with the facts of the Energy Tax Act specified in Section 2(2)(1) BEHG. Obligated party as per BEHG = Tax debtor |

| Placing on the market through the use of coal free of energy tax (Section 2(2)(2) BEHG) | In addition to coal subject to energy tax (see above), coal used free of energy tax in a procedure pursuant to Section 37(2)(3) or 37(2)(4) Energy Tax Act shall also be deemed to have been placed on the market from 2023 onwards. Installations shall not be considered as placed on the market. Obligated party as per BEHG = Permit holder for tax-free use |

| Placing on the market through use in waste incineration plants (Section 2(2a) BEHG) | Fuels are deemed to have been placed on the market if they are used in waste incineration plants requiring an immission control permit pursuant to Number 8.1.1 or 8.1.2 with waste oil as the main fuel of Annex 1 to the 4th BImSchV and are not already deemed to have been placed on the market pursuant to Article 2(2) BEHG. If such an installation is subject to the EU ETS, the fuel is not deemed to have been placed on the market. Obligated party as per BEHG = Operator of the installation |

If you are an obligated party as per BEHG, then you have three main obligations:

- Submission of a monitoring plan in 2023

- Annual submission of an emissions report

- Surrender emission allowances corresponding to your emissions.

Guidelines

Our Guideline for the 2023 to 2030 phase is aimed at obligated parties as per BEHG. In addition to basic information on participation in the nEHS, it describes the methods for determining fuel emissions depending on the "type" of placement on the market. The national emissions trading registry, the acquisition of emissions certificates and the verification of emissions reports are also covered in the Guideline.

(available in German only)

Monitoring Plan and Simplified Monitoring Plan

The monitoring plan is the basis of the annual emissions report. It comprises a complete and transparent documentation of the monitoring methods for the fuels placed on the market by you as the obligated party as per BEHG in a calendar year.

A monitoring plan must be submitted for the first time by 31/10/2023, for calendar year 2024. Obligated parties as per BEHG who are subject to the obligations of the BEHG for the first time within the 2024 to 2030 period must submit a monitoring plan immediately after commencing their commercial activities.

In certain cases, you may submit a simplified monitoring plan with reduced minimum content. Such a case exists if you calculate fuel emissions for the fuels you place on the market in a calendar year solely on the basis of

- Fuel quantities pursuant to Section 6(1) EBeV 2030 (energy tax quantities) and

- Default values for the calculation factors of the fuels according to Section 7 (1) and (2) EBeV 2030.

In addition to the above conditions, the requirements for a simplified monitoring plan are also met if deductions need be made to prevent double counting (Section 16 EBeV 2030) or double burden (Section 17 EBeV 2030) or biomass emissions need to be deducted (Section 8 EBeV 2030).

You create the monitoring plan (ÜP) in our form management system (see link). Then export the monitoring plan as a Zip file and transfer it to us via your DEHSt postbox in the DEHSt platform. A qualified electronic signature (QES) is required for the transmission of the monitoring plan. You can find more information on monitoring plans in chapters 5, 9 and 10 of our guidelines and on the topic pages on electronic communication.

More about electronic communication

Emission Report and ’Designation of Depositors’ Report

As an obligated party as per BEHG, you must prepare an emissions report by 31/07/ of each year and submit it to us. This report contains the fuels you put into circulation and the resulting emission quantities of the previous year. Operators of waste incineration plants must for the first time submit an emissions report for 2024 by 31/07/2025.

In cases where storage by third parties takes place in a fuel storage facility, the depositor takes the place of the tax warehouse keeper as the obligated party as per BEHG. Tax warehouse keepers who only store amounts for third parties and do not place any fuels on the market themselves are thus merely service providers and not obligated parties as per BEHG. However, as such a tax warehouse keeper, you must submit a "Designation of Depositors" report to us.

To the FMS - Designation of Depositors (available in German only)

Verification of the Emissions Report

In principle, before you submit the emissions report to us, it must be verified by an independent verifier in accordance with Section 15 of the BEHG by means of an inspection of the operating sites in accordance with Section 15 of the EBeV 2030.

An inspection at the operating sites of the obligated party as per BEHG is not required if the fuel emissions were determined on the basis of a simplified monitoring plan.

Verification of the emissions report may be waived if you, as the obligated party as per BEHG, exclusively determine the fuel emissions of the fuels you placed on the market in a calendar year

- based on a simplified monitoring plan and

- do not claim any deductions pursuant to Section 16 EBeV 2030 (Reliefs).

The basic requirement for verification and site visits also exists for the 2023 reporting year, for which no monitoring plan has yet to be submitted. However, for the same reporting year, a waiver of verification and site visit is also possible under the conditions described above.

More information on the verification of emissions reports can be found in Chapter 7 of our Guideline.

(available in German only)

Surrender obligation

As an obligated party as per BEHG, you are obliged to surrender emission allowances in the national emissions trading registry by September 30 of each year, corresponding to the amount of fuel emissions you reported. This means that for every tonne of CO2 you emit, you must surrender an emission allowance that entitles you to emit that same tonne of CO2.

In order to be able to surrender emission allowances, you must have a compliance account in the national emissions trading registry (nEHS registry). You can apply for the opening of a compliance account directly via the national emissions trading registry.

More information on opening accounts and emission allowance transactions can be found in Chapter 4 of our Guideline as well as in the Section ‘nEHS Registry’. For more information on the purchase of emission allowances and trading, see ‘Allowances: Sale and Trading’.

Overlaps between national and European emissions trading

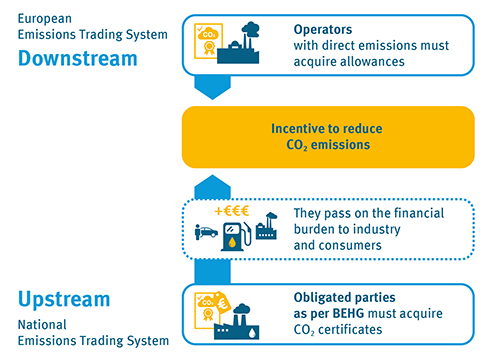

While the operators of participating installations in the European Emissions Trading Scheme 1 (EU ETS 1) determine and report the direct emissions from their installations (downstream approach), emissions in the national Emissions Trading Scheme (nEHS) are determined indirectly via the quantities of fuel placed on the market (upstream approach). In contrast to the EU ETS 1, therefore, it is not the emissions already produced that are recorded, but the emissions that may be released at a later date when the fuels are combusted.

Overlaps between national and European emissions trading 1 are therefore unavoidable (upstream and downstream approach).

If a fuel within the scope of the BEHG is delivered to an installation subject to the EU ETS 1 and used there, the emissions from this fuel are covered by both systems. Operators of EU ETS 1 installations could therefore theoretically be burdened with both the CO2 costs allocated to the fuel price under the nEHS and the costs for emission allowances in the EU ETS 1. To prevent this, there are two mechanisms in the BEHG:

- Prevention of double burden through advance deduction of fuel quantities pursuant to Section 7(5) BEHG in conjunction with Section 17 EBeV 2030: obligated parties as per BEHG can reduce their surrender obligation by the fuel quantities delivered to and used in EU ETS 1 installations. This eliminates the CO2 costs for such fuel quantities that they deliver to an EU ETS 1 installation (see Chapter 6.8 in our Guideline on the scope and monitoring and reporting of CO2 emissions in the National Emissions Trading System from 2023 to 2030).

- Subsequent compensation of double-loaded fuel quantities in accordance with the BEHG Double-Balancing Ordinance (BEDV): If an advance deduction pursuant to Section 7(5) BEHG in conjunction with Section 17 EBeV 2030 was not possible, EU ETS 1 operators can submit an application for subsequent compensation for the double burdens that could not be avoided in advance (see Chapter 2 in our Guideline on the interaction of EU ETS 1 and nEHS).

Guidance to EU ETS 1 operators and obligated parties as per BEHG on the prevention of double burden by means of advance deduction pursuant to Section 7(5) BEHG in conjunction with Section 17 EBeV 2030:

If the advance deduction pursuant to Section 7(5) BEHG in conjunction with Section 17 EBeV 2030 is to be used to prevent double burdens, the following three declarations are in particular required by law in the reports for national and EU ETS 1 emissions trading.

Declaration of intent to use: A private-sector declaration between the supplier obligated party as per BEHG and the EU ETS 1 installation to be supplied is a statement about the amount of fuel to be delivered qualifying for the advance deduction. Based on this declaration, the supplier can waive the purchase and surrender of emission allowances for the agreed delivery volume. DEHSt does not carry out an individual check or release of these declarations in advance. This declaration must be submitted together with the nEHS emissions report of the obligated party as per BEHG. This declaration does not have to be attached to the operator's EU ETS 1 emissions report.

Confirmation of cost exemption: Is a confirmation of the exemption from BEHG costs for the delivery volume agreed in the declaration of intent for advance deduction. No further separate declaration needs to be submitted. Cost exemption needs only to be confirmed by a checkbox in the nEHS emission report of the obligated party as per BEHG and in the operator’s EU ETS 1 emission report.

Confirmation of use: Based on the data in the EU ETS 1 emissions report, this certifies that the delivery volume agreed in the declaration of intent to use was actually used in the EU ETS 1 installation. The confirmation of use must be drawn up by the EU ETS 1 operator in the EU ETS 1 emissions report, which must be submitted to DEHSt by 31 March. The EU ETS 1 operator must also forward the confirmation of use to his supplier. The obligated party supplier as per BEHG must submit the confirmation together with the nEHS emission report by the deadline of 31 July. The volume confirmed by the confirmation of use can then be deducted in the nEHS emissions report.

The use of energy tax-exempt coal in EU ETS 1 installations is not subject to BEHG obligations. This means that EU ETS 1 operators do not have to issue a declaration of intent to use or a confirmation of use for these coal volumes.

Obligated parties as per BEHG can find further explanations about the advance deduction in Chapter 6.8 of our Guideline on the scope and about monitoring and reporting of CO2 emissions in national emissions trading from 2023 to 2030. The procedure for the advance deduction in the case where persons of the obligated party as per BEHG and the EU ETS 1 operator are identical is also discussed there.

EU ETS 1 operators can find further explanations on the advance deduction in Chapter 1 in our BEHG Guideline: Interaction of EU ETS 1 and nEHS. So far, Chapter 1 refers to the 2021 and 2022 Emission Reporting Ordinance (EBeV 2022) and thus to the advance deduction for 2021 and 2022. However, the basic procedure described in Chapter 1 was taken over in the 2030 EBeV for the 2023 to 2030 period. An update of Chapter 1 can be found in our BEHG Guideline: Interaction of EU ETS 1 and nEHS.