Understand and offset double burden

While operators of participating installations in the EU ETS 1 determine and report direct emissions from their installations (downstream approach), emissions within the National Emissions Trading System (nEHS) are determined indirectly via the quantities of fuel placed on the market (upstream approach). If a fuel within the scope of the nEHS is delivered to and used in an installation subject to the EU ETS 1, emissions from this fuel are covered by both systems.

Double burden due to fuel emissions from installations within the scope of the EU ETS 1 shall be prevented as far as possible using advance deduction pursuant to Section 7(5) BEHG in conjunction with Section 17 EBeV 2023. Where this is not possible, EU ETS 1 operators may offset double burdens that cannot be prevented in advance by subsequent offsetting in accordance with Section 11(2) in conjunction with the BEHG Double-Balancing Ordinance (BEDV). Storage quantities of fuels within the scope of the nEHS that are stored for later use in an EU ETS 1 installation are also deemed to be intended for use and thus double-burdened.

For stored fuel quantities for which subsequent offsetting was granted, the installation operator must provide proof of use in the following year in accordance with Section 6 (2) BEDV. We, the German Emissions Trading Authority (DEHSt), can extend the deadline for providing proof of use at the request of the installation operator.

Guidance (available in German only)

Basics of the application procedure

Applications for offsetting double burden must be submitted to us by July 31 of the calendar year following the accounting year in accordance with Section 8 (1) BEDV.

From the accounting year 2023 onwards, the application for offsetting double burden (Section 8 (3) BEDV) must include a certificate from a verification body (Section 21 (1) of the Greenhouse Gas Emissions Trading Act (TEHG)). The certificate must state that all factual information in the double burden application is free of material misstatements with reasonable certainty. The certificate is part of the FMS application in which the application is submitted. Since the accounting year 2023 onwards, there are fields for the verifiers. The information provided by the inspection body in these fields is regarded as a certificate (Section 8 (3) BEDV). The obligation to verify does not apply if the relevant emissions quantity for offsetting falls below 1,000 tons of CO2.

Operators within the EU ETS 1 must submit their applications for subsequent offsetting via the Virtual Post Office (VPS) using a qualified electronic signature. Please refer to our ‘Electronic communication’ page.

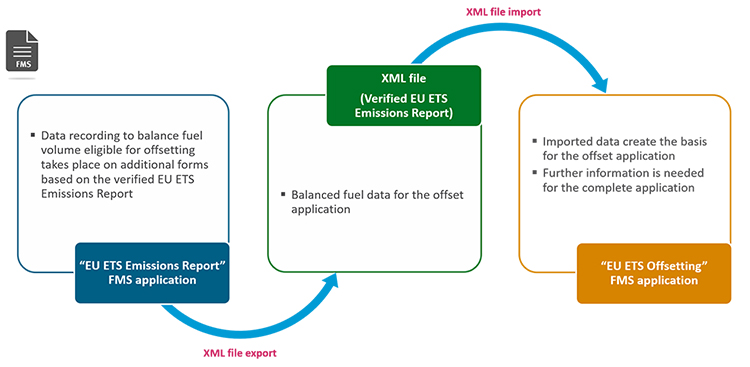

The application for subsequent offsetting can be created in a separate FMS application. You can use your existing access data to the FMS application for the EU ETS 1 emissions report for this purpose. The data for calculating the volume of fuel eligible for offsetting have to be recorded on the additional forms for the BEHG in the ‘EU ETS Emissions Report’ FMS application. Your verified EU ETS 1 emissions report is the basis for the recording. These forms also enable you to record the data for an advance deduction in accordance with Section 7(5) BEHG in conjunction with Section 17 EBeV 2023. The complete EU ETS 1 Emissions Report including the balanced fuel data from the additional forms for the BEHG is then exported from the ‘EU ETS Emissions Report’ FMS application and imported into the ‘EU ETS Offsetting’ FMS application. The imported data creates the basis for the offset application. In addition, further information is necessary for the complete application.

Further explanation on how to apply and fill in the FMS forms for the offset applications can be found in our ‘Guideline: Zusammenwirken EU-ETS und nEHS 2023 bis 2030’.

Evaluations and reports

In accordance with Section 11 BEDV (BEHG Double Balancing Ordinance), we, the German Emissions Trading Authority at the Federal Environment Agency (DEHSt), as the competent authority, regularly report to the Federal Government on the main results of the offsetting procedure. Such a report has been submitted for the first time by 31/05/2024.

The reports are included in the evaluation of the Fuel Emissions Trading Act (BEHG) and thus in the Federal Government's progress reports in accordance with Section 23 BEHG. These progress reports can be found under the following link.