Current notice

Application deadline

In accordance with point 6.1 of the Guideline on Aid for Indirect CO2 Costs, the deadline for applying for aid for indirect CO2 costs for the accounting year 2024 is 30/06/2025. We will provide you with further information on the application process in the coming weeks by newsletter and here on the DEHSt website.

Preparation of application

Requesting a file number

If you as a company would like to submit an application for the first time, we would kindly ask you to apply beforehand with the DEHSt (German Emissions Trading Authority) for a file number and an installation file number for each installation. If you are already using a file number for your company and wish to submit an application for a new installation, we would also kindly ask you to apply for an installation file number.

Please send us your application for a file number informally via the Virtual Post Office (VPS) system. Please note our information on the mandatory electronic signature.

Guidelines

We will be publishing our updated guidelines for this application year too. One set of guidelines is addressed to the applicants. In particular, this will address the proof of ecological compensation measures for the accounting years 2021 to 2024 that is required this year and will provide general information on the application process. Another set of guidelines provides guidance to accountants and sworn auditors. A third set of guidelines addresses the certification agencies.

FMS application software

This year too, applications will only be submitted digitally via the Form Management System (FMS). The FMS application software is expected to be available on the DEHSt website as of 1 April 2025. Please note that – as in the previous year – the application consists of two parts: Request for allowance and proof of ecological compensation measures.

We will inform you via our newsletter and on our website as soon as the application software is available.

Additional note on proof of ecological compensation measures

Even if you should not request allowance this year, please note that you are still obliged to provide proof of ecological compensation measures for the previous accounting years for which you received allowance.

Data backup

We strongly recommend that applicants make a backup of the last valid version of their application and of their proof of ecological compensation measures from the previous year.

To export the open data set, click the >>XML<< icon in the toolbar. The export process will then start and you will receive a note at the top of the form. You can download the XML file via the >>download exports<< entry in the main menu. For a detailed description, please refer to the manual in Chapter 4.8 for the FMS application Electricity Price Compensation.

(available in German only)

Strompreiskompensation – FMS-Handbuch

On the general FMS information page, we also provide step-by-step instructions, for example. on how to create exports from FMS applications.

(avaiable in German only)

Application process

Electronic Application

The FMS (Form Management System) acquisition software is available for you to use for your application.

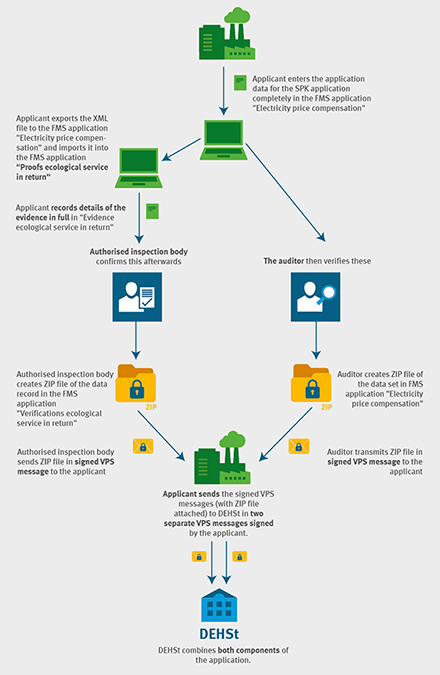

From the 2023 billing year, applications for electricity price compensation aid will consist of two components.

Two separate FMS applications must be used for the application:

1. “Electricity price compensation”: the FMS application previously used to record the application data

and

2. “Proof of environmental offsets”: A separate FMS application for the proof of environmental offsets as a prerequisite for the granting of aid in accordance with point 4 of the SPK funding guideline in conjunction with sections 10 and 11 BECV in accordance with the provisions of these guidelines or the guidelines for bodies authorized to carry out audits.

For your information, we provide you with an FMS manual for using the software as well as the “XSD”, the schema of the XML file, and the catalogs used. Using the schema of the XML file, you can import relevant data that you already manage in your own databases or software programs into DEHSt's FMS via a data interface.

New centralized user administration

With the start date 01/04/2024, the new centralized user administration in the “Form Management System” (FMS) will be used.

To start the application process, please create a new user account. You can then use this account in both FMS applications, “Electricity price compensation 2023” and “Proof of ecological compensation 2023”. In addition, this account will also be valid for the FMS application “Carbon Leakage Compensation” in national emissions trading (BEHG, BECV). This means that in future you will only need one account in the FMS and will be able to access all three applications. If you already have an account in the BEHG area of the FMS, you can already use it and do not need to create a new account. Please refer to the information text on the welcome pages of the FMS applications.

Electronic communication

The use of the Virtual Post Office (VPS) is mandatory for the application.

You will need a Qualified Electronic Signature Card (QES) to submit the grant application. You can purchase this signature card from various German trust service providers.

Please note that procurement and activation of the signature card and the necessary card reader can take up to three months. Please allow for this.

More about electronic communication

Eligible Sectors

Electricity price compensation is State aid for a limited group of eligible applicants. These are companies facing a significant risk of carbon leakage due to their production processes characterised by high electricity consumption and referred to as indirect carbon leakage (CL). However, this risk is not analysed individually. The State Aid Guidelines (Annex I) of the European Commission defines which sectors and subsectors are particularly at risk and therefore eligible for aid.

The eligibility of a company to apply is determined by the products manufactured, however, the allocation of a company to a specific economic sector is not critical. An application for State aid can only be made for products that are allocated to one of the sectors or subsectors listed, but it does not extend to further processing into products that are not eligible for aid.

Manuals and assistance