This creates the foundation for businesses to incorporate these costs into their decisions based on the polluter-pays principle. At the same time, revenues from the auctions open up financial scope to actively support climate protection measures, to advance the development of low-carbon technologies, and to enable socially balanced compensation measures.

Overview

Auctions of emission allowances as basic allocation method

The auctioning of emission allowances by the Federal Republic of Germany has already been taking place on the European Energy Exchange (EEX) in Leipzig since the beginning of 2010. The start of the German auctions on the EEX was preceded by two years of direct sales of emission allowances by the KfW (German credit institute for reconstruction), see also the Auctioning Factsheet.

Throughout Europe, it has been the basic allocation method in European emissions trading (EU ETS 1) since the beginning of the third trading period (2013 to 2020), with slightly more than half of the emission allowances being auctioned.

This also applies in principle to the fourth trading period, which started in 2021. The Federal Republic of Germany has an effective share of around 22 percent of this Europe-wide auction volume.

To the topic

Factsheet: Auctioning in EU ETS 1 (25/04/2025, PDF, 271KB, File meets accessibility standards)

What happens to the revenues?

Since 2012, the revenues from the auctions in Germany have flowed almost entirely into the Climate and Transformation Fund (KTF), formerly the Energy and Climate Fund. Already before 2012, a large proportion of the revenues from these sales went into various climate protection projects, thus making an important contribution to achieving the German government's energy and climate policy goals. Between 2008 and 2024, the federal government was able to raise a total of about 41,5 billion euros from the sale of over 1.8 billion emissions allowances.

A table showing the auction revenues since 2012 can be found under

Framework conditions

The EU Auctioning Regulation lays the foundation for the auctioning of allowances in the EU ETS 1 since the third trading period. In 2023, a new EU Auctioning Regulation was adopted as part of a fundamental revision and came into force in December 2023. Information on the European regulatory framework is provided on the website of the European Commission.

Reform measures: Backloading and Market Stability Reserve

To prevent the accumulation of surplus emission allowances, the so-called backloading was introduced in 2014, under which certain auction volumes are withheld and offered for auctioning on a deferred basis. Accordingly, between 2014 and 2016, 900 million less emission allowances (EU Allowances (EUAs)) were auctioned EU-wide than originally planned. In line with this decision, German auction volumes were reduced by some 175 million EU Allowances (EUAs) over said period. According to the decision at the time, the volumes withheld were to be returned to the market in 2019 and 2020.

Since 2019, the auction volumes have been controlled on a rule-based basis by the Market Stability Reserve (MSR) in addition to backloading. This means that the auction volumes are since reduced or increased annually by the MSR if there are too many or too few emission allowances in circulation. Also, the auction volumes withheld through backloading as mentioned above were transferred directly to the MSR in 2019, i.e. not returned to the market. Generally, allowances that were not allocated free of charge in the third trading period, so-called unallocated allowances were transferred to the MSR. The auction volume was reduced EU-wide by over 2 billion EUA in the period 2019 to 2024 in accordance with the MSR mechanism. The German auction volumes were reduced proportionately by almost 500 million EUA in this period.

For more on the Market Stability Reserve, see our page on

increasing climate protection ambition

Aviation

The aviation sector has been included in the EU ETS 1 since 2012. With an auctioning share of 15 percent of the aviation cap. However, this was suspended from November 2012 to September 2014 due to the "stopping the clock" decision. In 2012, Germany was the only Member State to auction aviation allowances (EUAA), as the auction took place before the decision.

From 2025 onwards, EUAA will no longer be auctioned on the primary market. The corresponding volumes will be auctioned proportionally as EUA spot contracts in the weekly auctions. This is in line with the requirements of the new EU Auctioning Regulation. In line with the European requirements, Germany carried out a total of twelve EUAA auctions in the years 2012 and 2015 to 2024. The auction on 16/10/2024 was the last auction of EUAA for Germany.

Maritime Transport

Starting in 2024 EU ETS 1 will be extended to cover emissions from maritime transport. The shipping sector will be fully integrated into the EU ETS 1 with 100 percent of the allocation being auctioned. 2024 and 2025 will serve as transition years where allowances have to be surrendered only for a portion of verified emissions (40 percent in 2024 and 70 percent in 2025). From 2026 onwards shipping companies have to surrender allowances for all verified emissions. In contrast to aviation there is no separate cap for emissions from the maritime sector. Instead shipping will be integrated into the existing market for emission allowances (EUA). To recognize the augmented scope the cap was increased by around 75 million EUA in 2024.

Further information on the German auctions of emission allowances can be found in our monthly auctioning reports. In addition to a detailed evaluation of the German auction results, these also contain a comprehensive overview of developments on the secondary market.

To the topic

Increasing Climate Protection Ambition

Factsheet: Auctioning in EU ETS 1 (25/04/2025, PDF, 271KB, File meets accessibility standards)

Climate Change 05/2022: Emissions trading and regulation of finacial markets

Auctioning results since 2012

To enable a smooth transition between the second and third trading periods, the EU member states decided to auction emission allowances from the 2013 and 2014 allocation years as early as 2012 (so-called early auctions). In addition to the early auctions of the third trading period, EEX also conducted the auctions of the German share of aviation allowances in 2012.

In 2024, a total of over 85 million EUAs and EUAAs with a total value of more than 5.5 billion euros were auctioned at the EEX for Germany. Average revenue in 2024 was below the previous year's figure.

The following table summarizes the auction results for the third trading period on an annual basis.

Functions of DEHSt at the auctions

To the topic

German Environment Agency awarded EEX with the contract of the German auction platform as of 2024

How does the auction process work?

The EU Auctioning Regulation ensures that ETS participants have harmonized, non-discriminatory and cost-efficient access to the European primary market for emission allowances.

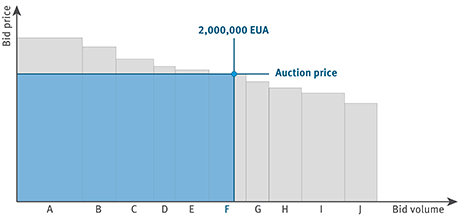

Auctions are held by using the established single-round, uniform-price procedure and a closed order book. The uniform price procedure means that all successful bidders pay the same price (see graphic below).

Uniform price auction at the EEX

The auction clearing price is determined by ranking all eligible bids, beginning with the highest bid, according to the bidding price.

In the event of equal bids, the bids are sorted by a random process. The bid volumes are aggregated starting with the highest bid until the volume of emission allowances on offer (e. g. here 2 million EU Allowances ()) is reached. The bid price at which the aggregate volume of bids reaches or exceeds the offered volume of auctioned allowances determines the auction clearing price (here bid F).

Bidders will thus be awarded their bid volume if their bidding price at least matches the auction clearing price. If a bid matches the clearing price exactly, the bidder may be awarded the remaining allowances which may be below the volume requested, depending on the bidding situation. If the bid from several participants matches the auction clearing price exactly, the above-mentioned random process applies. In the case of auctions on the primary market, existing infrastructures of the secondary market are used. Throughout the EU, auctions only take place on trading platforms that are part of regulated markets. For the auctions of aviation allowances, the same rules and procedures apply.

In addition to participation in an auction platform jointly commissioned by the European Commission and the Member States, the EU Auctioning Regulation provides for the possibility of Member States to operate their own platforms. In addition to Germany, Poland has also opted for this possibility. This allows bidders to use the trading platform best suited to their individual needs. Different trading platforms stimulate the competition in the secondary market.

Participation in the auctions

Access requirements

The EU Auctioning Regulation contains minimum requirements for appropriate access conditions. This is intended to enable a high level of bidder participation, especially from installation and aircraft operators as well as shipping companies subject to emissions trading. In addition the reliability and integrity of the auctioning process must be guaranteed. The access requirements are based on secondary market practices and allow also persons other than operators in emissions trading to access the auctions. In addition to direct Internet-based participation, the EU Auction Regulation also allows indirect access via authorized financial intermediaries.Trading participants who are already admitted to trade on the secondary market of the European Energy Exchange (EEX) can thus participate in the auctions in an uncomplicated manner and at no additional admission costs. Generally, the fees for participation in the auctions must not exceed comparable standard fees on the secondary market.

Auction-only access

Auction-only access is an EEX admission variant that simplifies participation in the auctions for emission allowances. It entitles companies to participate exclusively in primary auctions with simplified admission requirements: Since no technical access is required for this, bids can be entered into the trading system on behalf of the participant by the exchange's market supervision and transmitted, for example, by email. In particular, this saves costs for trained exchange traders and their verification. Furthermore, the use of bid submission by market supervision eliminates the annual fee. For the alternative use of a technical access to the trading system, only a reduced annual fee applies. Detailed information on the conditions of participation is available on the website of EEX.