Checklist for CBAM declarants

This checklist for CBAM applicants can help you to keep an overview of your reporting obligations. On the first page you will find an overview of the compliance cycle of the transition phase (01/10/2023-31/12/2025) and the regular phase (from 01/01/2026). On the second page you will find a step-by-step guide to fulfilling your reporting obligations during the transition phase.

(available in German only)

Reporting obligations from Q3 2024

During the transitional period, CBAM declarants will have to comply with amended reporting obligations from the 3rd quarter of 2024. In accordance with Article 4(3) of the CBAM Implementing Regulation (EU) 2023/1773, it will no longer be possible to use default values to determine embedded CO2 emissions from 1 August 2024.

CBAM declarants are obliged to determine and report the actual emissions for each import of CBAM goods from 01.08.2024 in accordance with the calculation methods set out in Article 4(1) or (2) of the CBAM Implementing Regulation (EU) 2023/1773.

If the CBAM declarant does not have data on actual emissions from suppliers and/or manufacturers for the CBAM goods, the declarant must explain that all necessary and proportionate steps have been taken and the reasons why it was not possible to obtain the required data on the CBAM goods from the supplier and/or manufacturer.

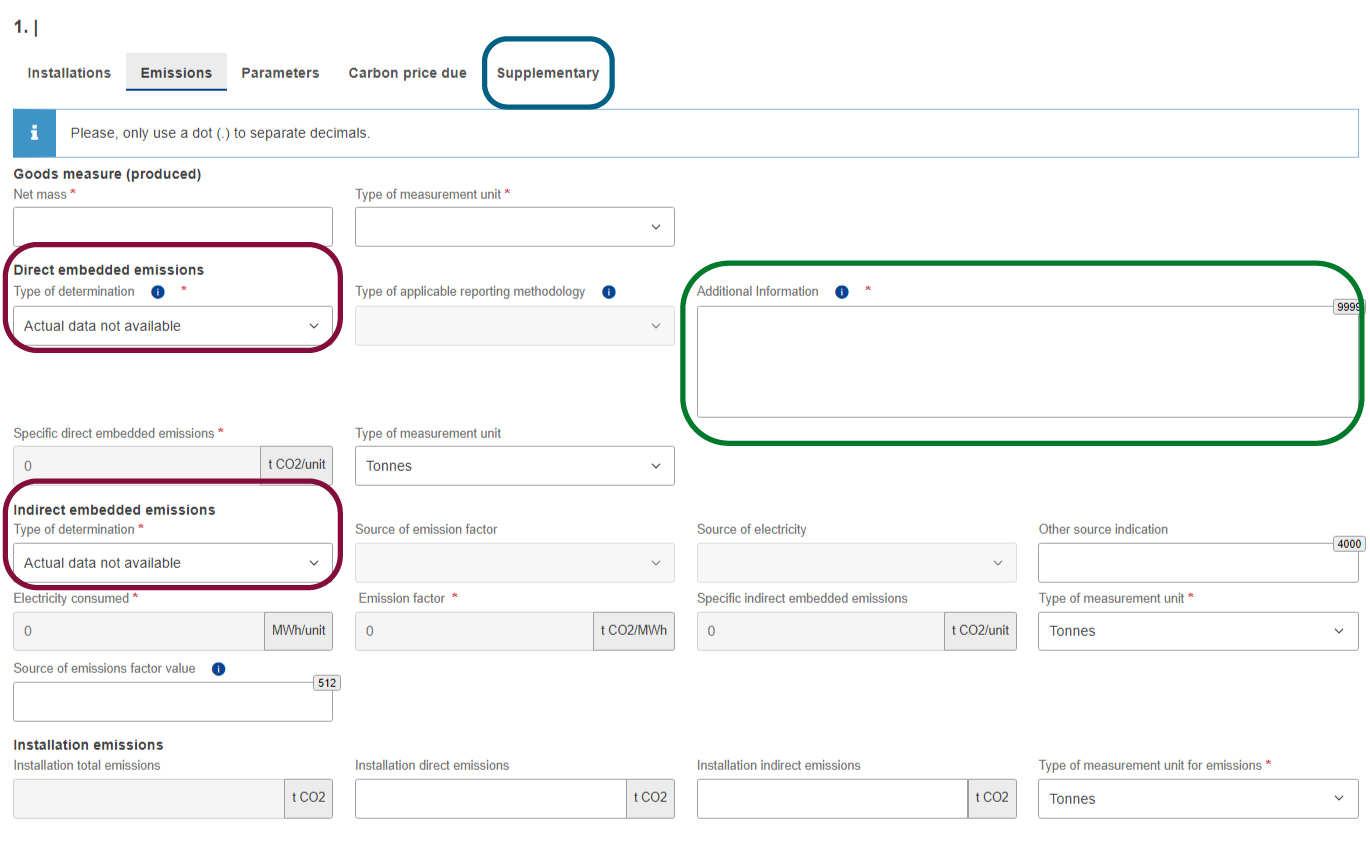

The Commission has simplified the format of the reporting obligation for this case. CBAM declarants no longer have to enter default values in the new format. The screenshot below explains which fields need to be filled in the CBAM transitional register.

- Please select the new option “Actual data not available” in the mandatory field “Direct embedded emissions - type of determination” circled in red above. By selecting this option, the number zero (0) is automatically inserted in the following field “Specific (direct) embedded emissions”.

- Proceed accordingly in the lower mandatory field “Indirect embedded emissions - type of determination” circled in red.

- In addition, briefly justify in the mandatory field “Additional information” circled in green that you have taken reasonable steps to report the actual emissions.

- Finally, you can click on the “Supplementary” tab circled in blue to document the unsuccessful efforts and steps taken to obtain data from suppliers and/or manufacturers.

In this context, we would like to point out that - if no documents have been uploaded under “Supplementary” - the following information will be provided:

Warning message: For imports as from 1 July 2024, reporting declarants are required to report actual emissions for each CBAM good imported into the EU. If the option "Actual data not available" is chosen, the CBAM report will be considered incorrect/incomplete. Reporting declarants must undertake all possible efforts to obtain actual emission data from their supplier(s) or producer(s) of CBAM goods. Where reporting declarants eventually fail to get data on actual emissions, this option shall be used. In addition, please follow these steps: 1. Use the "Additional Information" field to provide justifications on why the actual emissions data is missing. 2. In the tab "Supplementary", upload supporting documents attesting unsuccessful efforts and steps taken to obtain data from suppliers and/or producers.

DEHSt has discretionary powers when deciding whether to initiate a correction procedure in accordance with Article 14 of the CBAM Implementing Regulation (EU) 2023/1773. If the CBAM declarant has not used actual emission data in its CBAM report for the calculation of embedded emissions, DEHSt will exercise its margin of discretion.

In exercising its discretion, DEHSt will in particular take into account whether the declarant has

- has clearly demonstrated that he has taken all reasonable steps to report actual emissions and that further determination of actual data would have required a disproportionate effort, and/or

- has demonstrated that it has taken all reasonable steps to report actual emissions, and or

- whether there are any other discrepancies in the report submitted.

With regard to the question of the proportionality of the effort involved, DEHSt will in particular take into account the relevance of the underlying CO2 emissions of CBAM imports.

Notwithstanding DEHSt's discretion, the Commission may, in accordance with Art. 35(4) CBAM Regulation, instruct DEHSt to request additional information from CBAM declarants in order to complete or correct an incomplete or incorrect CBAM report.

We would also like to point out that sanctions according to Article 16 of the CBAM Implementing Regulation (EU) 2023/1773 will generally not be imposed without a prior rectification procedure.

It is still possible to use default values for electricity imports.

CBAM reports submitted under the previous requirements do not need to be corrected retrospectively, unless the Commission exercises its right to request additional information.

Frequent discrepancies in CBAM reports

CBAM reports often show extreme values in reported tonnes of goods that appear inconsistent with comparable trade data and patterns. To avoid potential errors that could lead to negative financial consequences due to unrealistic financial liabilities, please note the following information:

- The quantities in the CBAM registry must be reported in tonnes, not kilograms.

- The thousand and decimal separators must currently follow English conventions. For example, "1,000" is read as one thousand, and "1.5" as one and a half. Please ensure that the period is interpreted as the decimal separator. Entering commas is no longer possible in the transitional register.

- Ensure that quantities reported in the CBAM reported (in tonnes) correspond to quantities reported in customs declaration for the respective quarter (in tonnes).

Should the punctuation convention change in the German version of the registry, we will inform you via our newsletter.

Transition phase

The explanations apply to the so-called transition phase from 01/10/2023 to 31/12/2025. We will provide information on the subsequent regular phase from 01/01/2026 at a later date.

Participants and reporting obligation

All companies that import goods from third countries into the European Union’s customs territory that fall under Annex I of the CBAM Regulation (EU) 2023/956 are required to participate in CBAM. Imports from countries that participate in or are linked to the EU ETS are excluded from the application of the CBAM.

During the transitional phase, the applicable obligations of the declarant subject to reporting obligations are confined to complying with the reporting obligations under Articles 33, 34 and 35 of the CBAM Regulation (EU) 2023/956. Article 35 of the CBAM Regulation regulates the information the CBAM report must contain.

CBAM reports are submitted on a quarterly basis and must contain the following information:

- total quantity of each type of imported goods broken down by the factories in which the goods were produced in the country of origin

- actual grey emissions (direct and indirect emissions generated during production) for each type of goods

- CO2 price paid in the country of origin

Scope and sectors

CBAM applies to certain direct greenhouse gas emissions from products as defined in the Combined Nomenclature (CN) for the electricity, cement, iron and steel, fertilisers, hydrogen and aluminium sectors. These products are listed in Annex I of the CBAM Regulation (see Table 1 and Annex I of the CBAM Regulation (EU) 2023/956) and include CO2 emissions, as well as N2O emissions from the production of certain chemicals and PFC emissions from aluminium production. Certain further processed products (e.g. screws) also fall within the CBAM scope. Indirect emissions from electricity are covered by CBAM for the electricity, cement and fertilisers product groups (see Annex II of the CBAM Regulation (EU) 2023/956).

The CBAM Regulation also contains provisions for the inward processing procedure enabling companies to process goods imported from outside the EU customs territory without paying import duties, even before they decide whether to sell the finished products inside or outside the EU. This flexibility aids their decisions on logistical, commercial or other conditions. Finished products from CBAM goods resulting from the inward processing procedure are also covered by the CBAM Regulation, even if the finished products are not listed in Annex I of the CBAM Regulation (Article 2(1), Article 34(1)).

Sectors and products

| Sector | CN code | Description | |

|---|---|---|---|

| Note: | The sectors in italics above (i.e. cement, fertilisers and electricity) indicate that both direct and indirect emissions fall within the scope of CBAM during the transition period. For the other sectors, only direct emissions are initially recorded. | ||

| Source: | CBAM regulation (EU) 2023/956 | ||

| Cement | 2507 00 80 | Other kaolinic clays | CO2 |

| 2523 10 00 | Cement clinkers | CO2 | |

| 2523 21 00 | White Portland cement, whether or not artificially coloured | CO2 | |

| 2523 29 00 | Other Portland cement | CO2 | |

| 2523 30 00 | Aluminous cement | CO2 | |

| 2523 90 00 | Other hydraulic cements | CO2 | |

| Electricity | 2716 00 00 | Electrical energy | CO2 |

| Fertilisers | 2808 00 00 | Nitric acid; sulphonitric acids | CO2, N2O |

| 2814 | Ammonia, anhydrous or in aqueous solution | CO2 | |

| 2834 21 00 | Nitrates of potassium | CO2, N2O | |

| 3102 | Mineral or chemical fertilisers, nitrogenous | CO2, N2O | |

| 3105 | Mineral or chemical fertilisers containing two or three of the fertilising elements nitrogen, phosphorus and potassium; other fertilisers; goods of this chapter in tablets or similar forms or in packages of a gross weight not exceeding 10 kg Except: 3105 60 00– Mineral or chemical fertilisers containing the two fertilising elements phosphorus and potassium | CO2, N2O | |

| Iron and steel | 72 | Iron and steel Except: 7202 2 – Ferro-silicon 7202 30 00– Ferro-silico-manganese 7202 50 00– Ferro-silico-chromium 7202 70 00– Ferro-molybdenum 7202 80 00– Ferro-tungsten and ferro-silico-tungsten 7202 91 00– Ferro-titanium and ferro-silico-titanium 7202 92 00– Ferro-vanadium 7202 93 00– Ferro-niobium 7202 99– Other: 7202 99 10– Ferro-phosphorus 7202 99 30– Ferro-silico-magnesium 7202 99 80– Other 7204– Ferrous waste and scrap; remelting scrap ingots and steel | CO2 |

| 2601 12 00 | Agglomerated iron ores and concentrates, other than roasted iron pyrites | CO2 | |

| 7301 | Sheet piling of iron or steel, whether or not drilled, punched or made from assembled elements; welded angles, shapes and sections, of iron or steel | CO2 | |

| 7302 | Railway or tramway track construction material of iron or steel, the following: rails, check-rails and rack rails, switch blades, crossing frogs, point rods and other crossing pieces, sleepers (cross-ties), fish- plates, chairs, chair wedges, sole plates (base plates), rail clips, bedplates, ties and other material specialised for jointing or fixing rails | CO2 | |

| 7303 00 | Tubes, pipes and hollow profiles, of cast iron | CO2 | |

| 7304 | Tubes, pipes and hollow profiles, seamless, of iron (other than cast iron) or steel | ||

| Other tubes and pipes (for example, welded, riveted or similarly closed), having circular cross-sections, the external diameter of which exceeds 406,4 mm, of iron or steel | CO2 | ||

| 7306 | Other tubes, pipes and hollow profiles (for example, open seam or welded, riveted or similarly closed), of iron or steel | CO2 | |

| 7307 | Tube or pipe fittings (for example, couplings, elbows, sleeves), of iron or steel | CO2 | |

| 7308 | Structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge-sections, lock- gates, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, shutters, balustrades, pillars and columns), of iron or steel; plates, rods, angles, shapes, sections, tubes and the like, prepared for use in structures, of iron or steel | CO2 | |

| 7309 00 | Reservoirs, tanks, vats and similar containers for any material (other than compressed or liquefied gas), of iron or steel, of a capacity exceeding 300 l, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment | CO2 | |

| 7310 | Tanks, casks, drums, cans, boxes and similar containers, for any material (other than compressed or liquefied gas), of iron or steel, of a capacity not exceeding 300 l, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment | CO2 | |

| 7311 00 | Containers for compressed or liquefied gas, of iron or steel | CO2 | |

| 7318 | Screws, bolts, nuts, coach screws, screw hooks, rivets, cotters, cotter pins, washers (including spring washers) and similar articles, of iron or steel | CO2 | |

| 7326 | Other articles of iron or steel | CO2 | |

| Aluminium | 7601 | Unwrought aluminium | CO2, PFC |

| 7603 | Aluminium powders and flakes | CO2, PFC | |

| 7604 | Aluminium bars, rods and profiles | CO2, PFC | |

| 7605 | Aluminium wire | CO2, PFC | |

| 7606 | Aluminium plates, sheets and strip, of a thickness exceeding 0,2 mm | CO2, PFC | |

| 7607 | Aluminium foil (whether or not printed or backed with paper, paper- board, plastics or similar backing materials) of a thickness (excluding any backing) not exceeding 0,2 mm | CO2, PFC | |

| 7608 | Aluminium tubes and pipes | CO2, PFC | |

| 7609 00 00 | Aluminium tube or pipe fittings (for example, couplings, elbows, sleeves) | CO2, PFC | |

| 7610 | Aluminium structures (excluding prefabricated buildings of heading 9406) and parts of structures (for example, bridges and bridge-sections, towers, lattice masts, roofs, roofing frameworks, doors and windows and their frames and thresholds for doors, balustrades, pillars and columns); aluminium plates, rods, profiles, tubes and the like, prepared for use in structures | CO2, PFC | |

| 7611 00 00 | Aluminium reservoirs, tanks, vats and similar containers, for any material (other than compressed or liquefied gas), of a capacity exceeding 300 litres, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment | CO2, PFC | |

| 7612 | Aluminium casks, drums, cans, boxes and similar containers (including rigid or collapsible tubular containers), for any material (other than compressed or liquefied gas), of a capacity not exceeding 300 litres, whether or not lined or heat-insulated, but not fitted with mechanical or thermal equipment | CO2, PFC | |

| 7613 00 00 | Aluminium containers for compressed or liquefied gas | CO2, PFC | |

| 7614 | Stranded wire, cables, plaited bands and the like, of aluminium, not electrically insulated | CO2, PFC | |

| 7616 | Other articles of aluminium | CO2, PFC | |

| Chemicals | 2804 10 00 | Hydrogen | CO2 |

Exceptions

Specific countries of origin

Products whose countries of origin fall under or are linked to the EU ETS are excluded from the application of CBAM. Currently, these are Norway, Iceland, Liechtenstein and Switzerland.

Exemptions for goods other than electricity from certain countries of origin are listed in Annex III Section 1 of the CBAM Regulation; exemptions for electricity can be found in Section 2 (currently empty).

Exemption for military purposes

his applies to all goods imported by the military authorities of EU Member States or under an agreement with the military authorities of a non-EU state within the framework of the common security and defence policy of the EU or NATO.

Limited exemption for electricity imports

Imports of electricity from non-EU states are covered by CBAM, unless the non-EU state is so closely integrated into the internal EU electricity market that no technical solution can be found to apply CBAM to these imports; this exemption only applies in certain circumstances and under the conditions set out in Article 2 of the CBAM Regulation.

De-minimis exemption

Small amounts (de minimis) of imported goods that fall within CBAM’s scope are automatically exempt from the provisions of the CBAM Regulation, provided that the value of these goods is negligible, i.e. does not exceed 150 euros per consignment. This exemption also applies during the transitional phase.

CBAM regulation

Deadlines, report review and penalties

During the transitional phase, as a declarant subject to the reporting obligation, you must submit a CBAM report to the European Commission no later than one month after the conclusion of each quarter in a calendar year. The first quarter started on 01/10/2023 and ended on 31/12/2023, i.e. the first report must be submitted by 31/01/2024 at the latest.

In accordance with Article 9(1) of the CBAM Implementing Regulation, amendments to a submitted CBAM report are generally possible for two months after the end of the respective reporting quarter, i.e. up to one month after the CBAM reports’ submission deadline.

For the first two reporting quarters, the exception rule applies in accordance with Article 9(2) of the CBAM Implementing Regulation that reports submitted can be adjusted until the expiry of the submission deadline for the third CBAM report. Amendments to the first two reports are therefore still possible up to 31/07/2024.

In addition, the CBAM report may also be corrected after the deadline within one year of the end of the quarter concerned, if authorised by the competent authority, in accordance with Article 9(3) of the CBAM Implementing Regulation.

During the transitional phase and up to three months after the expiry of the submission deadline for the last CBAM report, the Commission may review the CBAM reports to check whether the reporting obligations have been complied with by the declarants subject to the reporting obligation (CBAM Implementing Regulation (EU) 2023/1773, Article 11(1)).

The following penalties are provided for under Article 16 of the CBAM Implementing Regulation:

- The penalty shall be between 10 euros and 50 euros per tonne of unreported emissions and shall be imposed if:

- the declarant subject to the reporting obligation fails to take the necessary actions to fulfil the obligation to submit a CBAM report

- the CBAM report is incomplete or inaccurate and the declarant fails to correct it even after being reminded to do so by the competent authority

Article 16(3) specifies certain circumstances to be taken into account at the discretion of the competent authority when determining the amount of the penalty. This includes the amount of unreported information, the amounts of unreported goods and the associated unreported emissions, whether the declarant subject to the reporting obligation acted intentionally or negligently, and the extent of cooperation of the declarant subject to the reporting obligation.

- Penalties of more than 50 euros per tonne of unreported emissions are considered:

- if incomplete or inaccurate reports have been submitted more than twice in succession, or

- the submission of a report has been missed for more than six months

Declarants subject to reporting obligations in Germany will not face penalties or other disadvantages due to the delayed availability of registration options for preparing CBAM reports.

Amendments to the CBAM reports for the first two reporting periods are permitted until 31/07/2024. In addition, the option of using default values in the CBAM reports until 31/07/2024 facilitates reporting.

Penalties outlined in Article 16 EU CBAM Implementing Regulation will generally not be imposed without the prior implementation of a rectification procedure. Finally, as the competent authority for initiating penalty procedures, we will duly consider the delayed availability of registration options and the willingness of declarants to cooperate in the application of the legislation within the bounds of our decision-making powers.

How do I find out if I have to participate?

CBAM goods are goods from the cement, iron and steel, aluminium, hydrogen, fertilisers and electricity sectors. When importing into a Member State of the European Union, the importer must compare the CN code of the imported goods with the list in Annex I of the CBAM Regulation. The European Commission provides a step-by-step guideline on how to identify goods covered by CBAM in Chapter 5.2 ‘Identifying CBAM goods’ of the guidance document on CBAM implementation for operators outside the EU.

A list of sectors and products can be found above

Distribution of roles and obligations of importers and operators in third countries

Operators of an installation in a third country that manufactures CBAM products have direct access to information on all emissions from the installation. The operator is therefore responsible for monitoring and reporting the embedded grey emissions of all produced goods imported into the EU.

The importer is the party obliged to report and who submits the CBAM reports to the European Commission on a quarterly basis during the transition phase and CBAM declarations annually during the regular phase. For this purpose, the reporting party requests the data on the grey emissions of the CBAM goods produced by the respective operator. The CBAM report can be prepared on this basis.

Further relevant information can be found in the guidance document on CBAM implementation for operators outside the EU in Chapter 4.

Further information by the EU

We try to keep the links up to date. However, as CBAM is still new, there are often changes on the European Commission's website that make the links out of date. In this case, we would be happy to hear from you.

Taxation and Customs Union: Carbon Border Adjustment Mechanism

Taxation and Customs Union: Carbon Border Adjustment Mechanism (CBAM) - Questions and Answers

Further questions?

Do you have further questions about submitting CBAM reports or the carbon border adjustment mechanism? Then please use the linked contact form.